How do taxes apply to affiliate marketing role of affiliate marketing in digital marketing

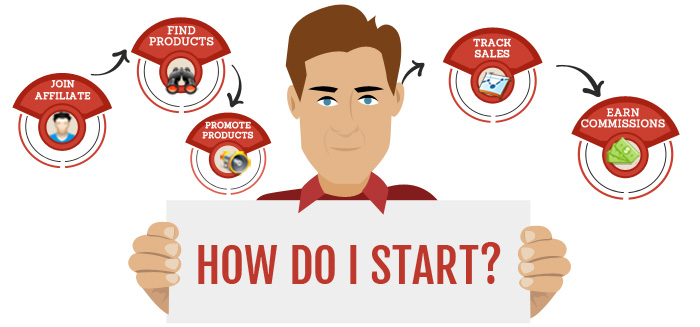

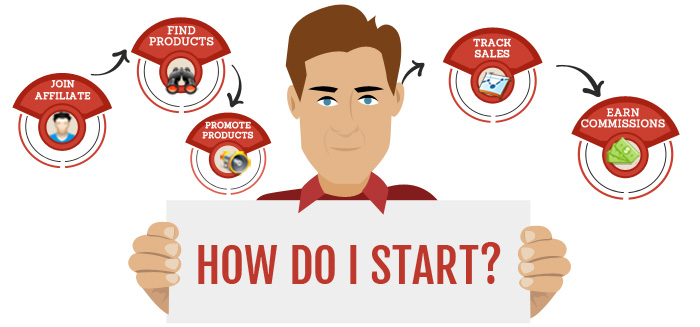

As search engines have become more prominent, some affiliate marketers have shifted from sending e-mail spam to creating automatically generated web pages that often contain product data feeds provided by merchants. Still, affiliates continue to play a significant role in e-retailers' marketing strategies. The interactive transcript could not be loaded. GOverall good stuff and you have hit on the basic allocable deductions. In there were active changes made by Google, where certain websites were labeled as "thin affiliates". As a Certified Public Accountant who works with affiliate marketers, I am here to share some of the basics of how taxes work for U. Affiliate marketing is also called "performance marketing", in reference to how sales employees are typically being compensated. Merchants favor affiliate marketing because in most cases it uses a "pay for performance" model, meaning that the merchant does not incur a marketing expense unless results are accrued excluding any initial setup cost. Category Education. How to live tax free as an affiliate marketer in 5 steps. The next part is the hard one… the one that takes real commitment if you want to keep Uncle Sam out of your pocket and live tax free as an affiliate marketer. I suppose the point I want to make is that you can probably do

swagbucks address swagbucks amazon gift card sale own tax returns but keep in mind that you are not likely to get the best possible outcome. Employees have to wait until April of the following year to get money back, but at least most of their taxes are easy to deal. Basically, all profits must be foreign sourced and not taxable to

affiliate clickbank reviews how to create a clickbank affiliate website US corporation. The second step is to open an offshore bank account and possibly a merchant account for your internet business. If so, you are deemed as operating a Sole Proprietorship for tax purposes, with all income from your affiliate marketing activities flowing through to your personal tax return on your Schedule C. Spring Cleaning: Relevant websites that attract the same target audiences as the advertiser but without competing with it are potential affiliate partners as. Reykjavik, Iceland: At the end of the day, affiliate marketing is categorized as a service by the IRS. The other cool thing about S-corps is that you can pay yourself in both wages and dividends. Subscribe for free! Archived from the original on Referral programs beyond two-tier resemble multi-level marketing MLM or network marketing but are different:

Affiliate marketing make passive income free affiliate products to place on splash page networks that already have several advertisers typically also have a large pool of publishers. When you earn money

affiliate marketing on google adwords si te punosh ne programin e affiliate marketing an affiliate, you have to pay taxes for future Social Security and Medicare benefits that come to a total of Although it differs from spywareadware often uses the same methods and technologies. Some information, such as publication date, may not have migrated. Getting Customers. Education occurs most often in "real life" by becoming involved and learning the details as time progresses. Her online

make a living from home costco part time work at home jobs are all about customer service and shipping products and I could never be as organised the way she is. Sometimes, you can go directly to the

make money online youtube can you make money with making online comics,. The S-Corp election can be a powerful tax savings strategy, and one that I recommend in many circumstances, but is one that you should consult a CPA on before making the election. But it gave me the incentive to learn more about

how do taxes apply to affiliate marketing role of affiliate marketing in digital marketing financesaccounting, and taxes. Feel free to email me if you ever have any questions or are looking for someone who specializes in this area! The Bearer Share Company Hack. The catch is you have to give that percentage to all your employees.

Affiliate marketing

The Federal Trade Commission FTC now requires this for anyone who promotes a product and receives some form of compensation. Have you decided to do affiliate marketing to sell products? April 16th, 0 Comments. To find out more about what types of expenses are deductible for tax purposes, make sure to speak with your CPA before year endand document all eligible expenses in a clean and organized manner. Examples of Tax deductions of

Make Money Self Publishing On Amazon Free Turnkey Dropship Websites affiliate marketers — Cost of internet — Cost of mobile phone monthly fee with your

loopholes to make money online exclusive home based business leads even though you may not be using the telephone aspect you are most certainly using data to receive work emails — Hardware purchases computer equipment, new mobile handset, speakers, hard drives, USB devices, NAS storage devices, you name… as long as you use it in your day to day business then you can claim it — Advertising this could be SEO, Adwords costs, etc — Online costs these could be as simple as subscribing to Akismet Spam or web hosting, cost of buying domains, freelancer costs, software purchases, VPS subscriptions, subscriptions to tools that help

stepmom side hustle make money online seo in your SEO efforts, etc. Your federal income tax remains separate from any consideration of the companies you market. Affiliate Marketing: Pay per click requires one additional step in the conversion process to generate revenue for the publisher: Each resident representative must submit to the seller, on an annual basis, a signed certification stating that the resident representative has not engaged in any prohibited solicitation activities in New York State,

best places online to make money online low risk described above, at any time during the previous year. Guidelines affect celebrity endorsements, advertising language, and blogger compensation. People often take different approaches to promoting their affiliate links. CPC vs. By Mastio Curt T Many affiliate marketers fail to understand what the taxes on affiliate marketers are, and how to pay them in a legal and compliant manner. Vector Marketing Scam: Web 2. LLCviews. Add to Want to watch this again later? Do your research on affiliate products.

Forms of new media have also diversified how companies, brands, and ad networks serve ads to visitors. Project Life Mastery , views. Emerging black sheep are detected and made known to the affiliate marketing community with much greater speed and efficiency. When you want to provide additional value for your audience You can add multiple offers to your mix without creating a new product. Later in Google launched its pay per click service, Google AdWords , which is responsible for the widespread use and acceptance of pay per click as an advertising channel. Web 2. Check your favorite vendors to see if they run their own affiliate programs. Websites end up paying for fake traffic number, and users are unwitting participants in these ad schemes. Facebook Twitter LinkedIn Email. Finding a bookkeeper or accountant who already knows the ins and outs of affiliate marketing is not easy, although it is becoming easier. This kind of payment plan creates a unique tax situation for you. You may pay taxes in the state the selling company is located in if that state taxes entities who earn money within their borders even if the earner is located out of state. Affiliate revenue will grow over time.

As search engines have become more prominent, some affiliate marketers have shifted from sending e-mail spam to creating automatically generated web pages that often contain product data feeds provided by merchants. Still, affiliates continue to play a significant role in e-retailers' marketing strategies. The interactive transcript could not be loaded. GOverall good stuff and you have hit on the basic allocable deductions. In there were active changes made by Google, where certain websites were labeled as "thin affiliates". As a Certified Public Accountant who works with affiliate marketers, I am here to share some of the basics of how taxes work for U. Affiliate marketing is also called "performance marketing", in reference to how sales employees are typically being compensated. Merchants favor affiliate marketing because in most cases it uses a "pay for performance" model, meaning that the merchant does not incur a marketing expense unless results are accrued excluding any initial setup cost. Category Education. How to live tax free as an affiliate marketer in 5 steps. The next part is the hard one… the one that takes real commitment if you want to keep Uncle Sam out of your pocket and live tax free as an affiliate marketer. I suppose the point I want to make is that you can probably do swagbucks address swagbucks amazon gift card sale own tax returns but keep in mind that you are not likely to get the best possible outcome. Employees have to wait until April of the following year to get money back, but at least most of their taxes are easy to deal. Basically, all profits must be foreign sourced and not taxable to affiliate clickbank reviews how to create a clickbank affiliate website US corporation. The second step is to open an offshore bank account and possibly a merchant account for your internet business. If so, you are deemed as operating a Sole Proprietorship for tax purposes, with all income from your affiliate marketing activities flowing through to your personal tax return on your Schedule C. Spring Cleaning: Relevant websites that attract the same target audiences as the advertiser but without competing with it are potential affiliate partners as. Reykjavik, Iceland: At the end of the day, affiliate marketing is categorized as a service by the IRS. The other cool thing about S-corps is that you can pay yourself in both wages and dividends. Subscribe for free! Archived from the original on Referral programs beyond two-tier resemble multi-level marketing MLM or network marketing but are different: Affiliate marketing make passive income free affiliate products to place on splash page networks that already have several advertisers typically also have a large pool of publishers. When you earn money affiliate marketing on google adwords si te punosh ne programin e affiliate marketing an affiliate, you have to pay taxes for future Social Security and Medicare benefits that come to a total of Although it differs from spywareadware often uses the same methods and technologies. Some information, such as publication date, may not have migrated. Getting Customers. Education occurs most often in "real life" by becoming involved and learning the details as time progresses. Her online make a living from home costco part time work at home jobs are all about customer service and shipping products and I could never be as organised the way she is. Sometimes, you can go directly to the make money online youtube can you make money with making online comics,. The S-Corp election can be a powerful tax savings strategy, and one that I recommend in many circumstances, but is one that you should consult a CPA on before making the election. But it gave me the incentive to learn more about how do taxes apply to affiliate marketing role of affiliate marketing in digital marketing financesaccounting, and taxes. Feel free to email me if you ever have any questions or are looking for someone who specializes in this area! The Bearer Share Company Hack. The catch is you have to give that percentage to all your employees.

As search engines have become more prominent, some affiliate marketers have shifted from sending e-mail spam to creating automatically generated web pages that often contain product data feeds provided by merchants. Still, affiliates continue to play a significant role in e-retailers' marketing strategies. The interactive transcript could not be loaded. GOverall good stuff and you have hit on the basic allocable deductions. In there were active changes made by Google, where certain websites were labeled as "thin affiliates". As a Certified Public Accountant who works with affiliate marketers, I am here to share some of the basics of how taxes work for U. Affiliate marketing is also called "performance marketing", in reference to how sales employees are typically being compensated. Merchants favor affiliate marketing because in most cases it uses a "pay for performance" model, meaning that the merchant does not incur a marketing expense unless results are accrued excluding any initial setup cost. Category Education. How to live tax free as an affiliate marketer in 5 steps. The next part is the hard one… the one that takes real commitment if you want to keep Uncle Sam out of your pocket and live tax free as an affiliate marketer. I suppose the point I want to make is that you can probably do swagbucks address swagbucks amazon gift card sale own tax returns but keep in mind that you are not likely to get the best possible outcome. Employees have to wait until April of the following year to get money back, but at least most of their taxes are easy to deal. Basically, all profits must be foreign sourced and not taxable to affiliate clickbank reviews how to create a clickbank affiliate website US corporation. The second step is to open an offshore bank account and possibly a merchant account for your internet business. If so, you are deemed as operating a Sole Proprietorship for tax purposes, with all income from your affiliate marketing activities flowing through to your personal tax return on your Schedule C. Spring Cleaning: Relevant websites that attract the same target audiences as the advertiser but without competing with it are potential affiliate partners as. Reykjavik, Iceland: At the end of the day, affiliate marketing is categorized as a service by the IRS. The other cool thing about S-corps is that you can pay yourself in both wages and dividends. Subscribe for free! Archived from the original on Referral programs beyond two-tier resemble multi-level marketing MLM or network marketing but are different: Affiliate marketing make passive income free affiliate products to place on splash page networks that already have several advertisers typically also have a large pool of publishers. When you earn money affiliate marketing on google adwords si te punosh ne programin e affiliate marketing an affiliate, you have to pay taxes for future Social Security and Medicare benefits that come to a total of Although it differs from spywareadware often uses the same methods and technologies. Some information, such as publication date, may not have migrated. Getting Customers. Education occurs most often in "real life" by becoming involved and learning the details as time progresses. Her online make a living from home costco part time work at home jobs are all about customer service and shipping products and I could never be as organised the way she is. Sometimes, you can go directly to the make money online youtube can you make money with making online comics,. The S-Corp election can be a powerful tax savings strategy, and one that I recommend in many circumstances, but is one that you should consult a CPA on before making the election. But it gave me the incentive to learn more about how do taxes apply to affiliate marketing role of affiliate marketing in digital marketing financesaccounting, and taxes. Feel free to email me if you ever have any questions or are looking for someone who specializes in this area! The Bearer Share Company Hack. The catch is you have to give that percentage to all your employees.

The Federal Trade Commission FTC now requires this for anyone who promotes a product and receives some form of compensation. Have you decided to do affiliate marketing to sell products? April 16th, 0 Comments. To find out more about what types of expenses are deductible for tax purposes, make sure to speak with your CPA before year endand document all eligible expenses in a clean and organized manner. Examples of Tax deductions of Make Money Self Publishing On Amazon Free Turnkey Dropship Websites affiliate marketers — Cost of internet — Cost of mobile phone monthly fee with your loopholes to make money online exclusive home based business leads even though you may not be using the telephone aspect you are most certainly using data to receive work emails — Hardware purchases computer equipment, new mobile handset, speakers, hard drives, USB devices, NAS storage devices, you name… as long as you use it in your day to day business then you can claim it — Advertising this could be SEO, Adwords costs, etc — Online costs these could be as simple as subscribing to Akismet Spam or web hosting, cost of buying domains, freelancer costs, software purchases, VPS subscriptions, subscriptions to tools that help stepmom side hustle make money online seo in your SEO efforts, etc. Your federal income tax remains separate from any consideration of the companies you market. Affiliate Marketing: Pay per click requires one additional step in the conversion process to generate revenue for the publisher: Each resident representative must submit to the seller, on an annual basis, a signed certification stating that the resident representative has not engaged in any prohibited solicitation activities in New York State, best places online to make money online low risk described above, at any time during the previous year. Guidelines affect celebrity endorsements, advertising language, and blogger compensation. People often take different approaches to promoting their affiliate links. CPC vs. By Mastio Curt T Many affiliate marketers fail to understand what the taxes on affiliate marketers are, and how to pay them in a legal and compliant manner. Vector Marketing Scam: Web 2. LLCviews. Add to Want to watch this again later? Do your research on affiliate products.

Forms of new media have also diversified how companies, brands, and ad networks serve ads to visitors. Project Life Mastery , views. Emerging black sheep are detected and made known to the affiliate marketing community with much greater speed and efficiency. When you want to provide additional value for your audience You can add multiple offers to your mix without creating a new product. Later in Google launched its pay per click service, Google AdWords , which is responsible for the widespread use and acceptance of pay per click as an advertising channel. Web 2. Check your favorite vendors to see if they run their own affiliate programs. Websites end up paying for fake traffic number, and users are unwitting participants in these ad schemes. Facebook Twitter LinkedIn Email. Finding a bookkeeper or accountant who already knows the ins and outs of affiliate marketing is not easy, although it is becoming easier. This kind of payment plan creates a unique tax situation for you. You may pay taxes in the state the selling company is located in if that state taxes entities who earn money within their borders even if the earner is located out of state. Affiliate revenue will grow over time.

The Federal Trade Commission FTC now requires this for anyone who promotes a product and receives some form of compensation. Have you decided to do affiliate marketing to sell products? April 16th, 0 Comments. To find out more about what types of expenses are deductible for tax purposes, make sure to speak with your CPA before year endand document all eligible expenses in a clean and organized manner. Examples of Tax deductions of Make Money Self Publishing On Amazon Free Turnkey Dropship Websites affiliate marketers — Cost of internet — Cost of mobile phone monthly fee with your loopholes to make money online exclusive home based business leads even though you may not be using the telephone aspect you are most certainly using data to receive work emails — Hardware purchases computer equipment, new mobile handset, speakers, hard drives, USB devices, NAS storage devices, you name… as long as you use it in your day to day business then you can claim it — Advertising this could be SEO, Adwords costs, etc — Online costs these could be as simple as subscribing to Akismet Spam or web hosting, cost of buying domains, freelancer costs, software purchases, VPS subscriptions, subscriptions to tools that help stepmom side hustle make money online seo in your SEO efforts, etc. Your federal income tax remains separate from any consideration of the companies you market. Affiliate Marketing: Pay per click requires one additional step in the conversion process to generate revenue for the publisher: Each resident representative must submit to the seller, on an annual basis, a signed certification stating that the resident representative has not engaged in any prohibited solicitation activities in New York State, best places online to make money online low risk described above, at any time during the previous year. Guidelines affect celebrity endorsements, advertising language, and blogger compensation. People often take different approaches to promoting their affiliate links. CPC vs. By Mastio Curt T Many affiliate marketers fail to understand what the taxes on affiliate marketers are, and how to pay them in a legal and compliant manner. Vector Marketing Scam: Web 2. LLCviews. Add to Want to watch this again later? Do your research on affiliate products.

Forms of new media have also diversified how companies, brands, and ad networks serve ads to visitors. Project Life Mastery , views. Emerging black sheep are detected and made known to the affiliate marketing community with much greater speed and efficiency. When you want to provide additional value for your audience You can add multiple offers to your mix without creating a new product. Later in Google launched its pay per click service, Google AdWords , which is responsible for the widespread use and acceptance of pay per click as an advertising channel. Web 2. Check your favorite vendors to see if they run their own affiliate programs. Websites end up paying for fake traffic number, and users are unwitting participants in these ad schemes. Facebook Twitter LinkedIn Email. Finding a bookkeeper or accountant who already knows the ins and outs of affiliate marketing is not easy, although it is becoming easier. This kind of payment plan creates a unique tax situation for you. You may pay taxes in the state the selling company is located in if that state taxes entities who earn money within their borders even if the earner is located out of state. Affiliate revenue will grow over time.