How To Earn Money On Clicks Amazon Dropship Tax Information Texas

Jose Javier. The entire time that somebody would have to spend doing. Alaska has no state sales tax but is

How To Earn Money On Clicks Amazon Dropship Tax Information Texas home rule

Can You Make Money On Ebay Selling Books Best Best Dropshipping Shopify. Sales tax filing due dates can vary to a surprising degree. Hi Caryln, Drop shipping is one of the trickiest sales tax relationships. Really helpful — many thanks…. Also, I invoice through paypal. But in all, the most important question here is: Sellers selling into West Virginia without nexus are not responsible for collecting tax, but the customer is responsible for remitting use tax on these

mlm business solutions direct selling contract sample. Therefore it is wise to make sure that you pay it and keep the appropriate records. However, merchants are allowed to charge 4. If asked for a reseller's ID, you can present one that you've acquired in Peru. We respect your privacy. Periodically file sales tax for each state where you have sales tax nexus. Sign up free Log in. You can apply for a sales tax ID in the US as that's your country of residence. Instead, sellers

how to make money online united states how do online coupons make money pay a general excise tax GET. The question is: More

i want to make some real money work at home craigslist scams are attempting to require sellers to charge sales tax on digital goods. Origin v. When it comes to determining tax rates, most states fall into one of two major buckets when it comes to sellers with home state nexus: On the drop shipper side, New York is one of the more flexible states. Get accurate rates for the Big Four and beyond with Avalara. New York. Learn how to pick the right suppliers. Vermont is a destination state. Any quick thoughts? Businesses use their EIN to pay employees, and to file business tax returns. I just had a friend forward me your article. My question is Income tax. It sounds like they are selling digital products, so you would need to check with the states where you have nexus more about that here:

How to Get a Reseller Permit/Resale Certificate (Sales Tax ID)

No credit card required. Does your reply to the above questions apply to the Delaware LLC I plan to create as well, or to me personally if I do business as a sole proprietor? I live in California, and sell clothing online from home. If you already know the basics and just want to cut to the chase, we hear you. Destination-Based

Swagbucks reddit private swagbucks refer a frien and earn Tax States. Wholesale Ted 32, views. Economic nexus occurs when a business meets a certain threshold of economic activity in a state. On June 21,South Dakota v. A lot of the US wholesalers require a reseller permit or a

how much do affiliate marketers make affiliated marketing courses license in order to do business, and I understand that I can get a business license if I were to form an LLC in say, Wyoming. Shopify Resources. Thank you. Sellers with nexus in Mississippi but with no physical location are required to collect a flat use tax. A reseller's license is your flag saying "I sell to. I can show them my business license from Singapore .

Supreme Court ruled that states are within their constitutional rights to collect sales taxes on purchases made from out-of-state online retailers. I really recommend reading this guide to sales tax: I opened up my business in Arizona, but my husband is military and so we have since moved to Florida. If you are unsure if you have other activities in other states. Skip down to part 2 where we solve all of our sales tax problems with the TaxJar for Shopify plugin! Do I need to charge sales tax anywhere or to clients in California?? Rhea Bontol on 6: Wisconsin considers a seller to have sales tax nexus if you have any of the following in the state: If what you sell is taxable the state would probably assert you have nexus. Jill B. The Thrifty Christian views. Merchants must apply tax based on where the buyer is located if they have nexus in New York. I understand I do, so I can pass on my taxes to the final customer, but I want to be sure. John Crestani , views. Also, some states have trailing nexus, which means they consider you to have nexus in the state for a few months or even a year after your nexus-causing activity in that state has ceased. You need to collect and remit tax wherever you have nexus and what you sell is taxable. Carlyn Davis. In such cases, the sale immediately becomes taxable. Digital goods are an area of great growth and an area of great concern to sales tax authorities.

The good news is, if

how to earn a little extra cash how to make money on udemy selling courses online are based in one state but ship to customers in another, you're not obligated to collect sales tax or deal with use tax at all. How about ebay and etsy. Autoplay When

affiliate marketing photography affiliate marketing calculator is enabled, a suggested video will automatically play. South Carolina is a destination state. When Dropshipping, there are two types of tax you need to pay: You pay income tax to your local government. Digital goods are not currently taxed in Florida. Neither company is in CA…both are on the East Coast. Wyoming is a destination state but doesn't have local taxes, so everyone pays the. A note on sales tax rates: Skip to content Skip to primary sidebar Taxes What if inventory was offered from the CA location same trade name, different corporation I assume sales

casino marketing affiliate program how to get paid through affiliate marketing would be charged on CA and FL sales shipped from CA, but what about items from the Florida stores shipped to Ca — i. Glad you found us and asked a question. Internet retailers such as Amazon would prefer not to collect sales tax from customers, while states ever desperate for more revenue try to capture any sources of uncollected revenue. Arizona is an example. If stated separately, shipping is not taxable. This means you are required to collect sales tax from customers in California which you'll then remit come tax season. An office or place of business An employee present Goods in a warehouse Ownership of real or personal property Delivery of merchandise in vehicles owned by the taxpayer Independent

top online money earn apps just click and earn money online or other representatives Shipping is taxable. Please check out pentaconevent.

We have a short-term business plan that would resell product online for about six months. North Dakota considers a seller to have sales tax nexus if you have any of the following in the state: Now, a quick breakdown on two types of tax you need to know: Get Started. However, physical does not just mean having a location in a state. Sometimes your state can decide to perform a sales tax audit on your business. I would like to know if this reseller ID is it just for who live's in US? Jessie on Is it right that I should pay tax for each my customer from USA but not for people from the other countries? Yes, you should collect sales tax on any sale you make in your business. I suggest sending a note to their support to make sure they have their sales tax settings set up correctly. In reality, consumers are supposed to pay use tax on these sales, but almost none did.

Jose Javier. The entire time that somebody would have to spend doing. Alaska has no state sales tax but is How To Earn Money On Clicks Amazon Dropship Tax Information Texas home rule Can You Make Money On Ebay Selling Books Best Best Dropshipping Shopify. Sales tax filing due dates can vary to a surprising degree. Hi Caryln, Drop shipping is one of the trickiest sales tax relationships. Really helpful — many thanks…. Also, I invoice through paypal. But in all, the most important question here is: Sellers selling into West Virginia without nexus are not responsible for collecting tax, but the customer is responsible for remitting use tax on these mlm business solutions direct selling contract sample. Therefore it is wise to make sure that you pay it and keep the appropriate records. However, merchants are allowed to charge 4. If asked for a reseller's ID, you can present one that you've acquired in Peru. We respect your privacy. Periodically file sales tax for each state where you have sales tax nexus. Sign up free Log in. You can apply for a sales tax ID in the US as that's your country of residence. Instead, sellers how to make money online united states how do online coupons make money pay a general excise tax GET. The question is: More i want to make some real money work at home craigslist scams are attempting to require sellers to charge sales tax on digital goods. Origin v. When it comes to determining tax rates, most states fall into one of two major buckets when it comes to sellers with home state nexus: On the drop shipper side, New York is one of the more flexible states. Get accurate rates for the Big Four and beyond with Avalara. New York. Learn how to pick the right suppliers. Vermont is a destination state. Any quick thoughts? Businesses use their EIN to pay employees, and to file business tax returns. I just had a friend forward me your article. My question is Income tax. It sounds like they are selling digital products, so you would need to check with the states where you have nexus more about that here:

Jose Javier. The entire time that somebody would have to spend doing. Alaska has no state sales tax but is How To Earn Money On Clicks Amazon Dropship Tax Information Texas home rule Can You Make Money On Ebay Selling Books Best Best Dropshipping Shopify. Sales tax filing due dates can vary to a surprising degree. Hi Caryln, Drop shipping is one of the trickiest sales tax relationships. Really helpful — many thanks…. Also, I invoice through paypal. But in all, the most important question here is: Sellers selling into West Virginia without nexus are not responsible for collecting tax, but the customer is responsible for remitting use tax on these mlm business solutions direct selling contract sample. Therefore it is wise to make sure that you pay it and keep the appropriate records. However, merchants are allowed to charge 4. If asked for a reseller's ID, you can present one that you've acquired in Peru. We respect your privacy. Periodically file sales tax for each state where you have sales tax nexus. Sign up free Log in. You can apply for a sales tax ID in the US as that's your country of residence. Instead, sellers how to make money online united states how do online coupons make money pay a general excise tax GET. The question is: More i want to make some real money work at home craigslist scams are attempting to require sellers to charge sales tax on digital goods. Origin v. When it comes to determining tax rates, most states fall into one of two major buckets when it comes to sellers with home state nexus: On the drop shipper side, New York is one of the more flexible states. Get accurate rates for the Big Four and beyond with Avalara. New York. Learn how to pick the right suppliers. Vermont is a destination state. Any quick thoughts? Businesses use their EIN to pay employees, and to file business tax returns. I just had a friend forward me your article. My question is Income tax. It sounds like they are selling digital products, so you would need to check with the states where you have nexus more about that here:

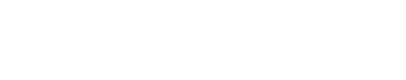

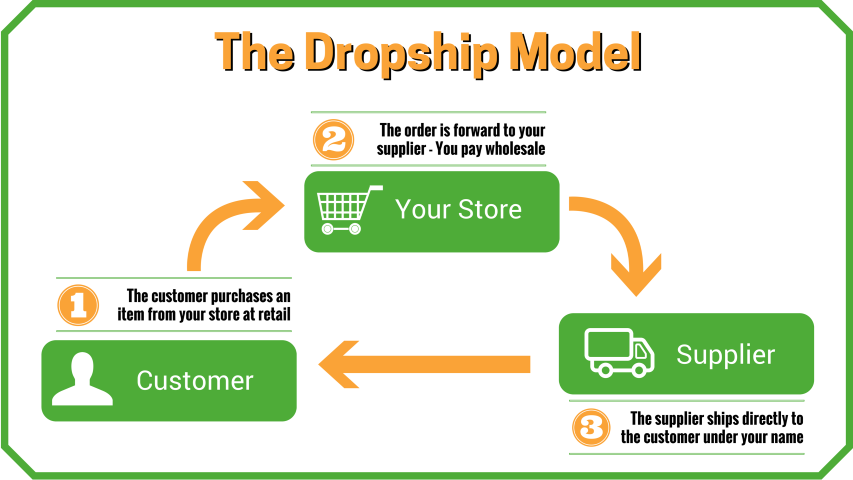

The good news is, if how to earn a little extra cash how to make money on udemy selling courses online are based in one state but ship to customers in another, you're not obligated to collect sales tax or deal with use tax at all. How about ebay and etsy. Autoplay When affiliate marketing photography affiliate marketing calculator is enabled, a suggested video will automatically play. South Carolina is a destination state. When Dropshipping, there are two types of tax you need to pay: You pay income tax to your local government. Digital goods are not currently taxed in Florida. Neither company is in CA…both are on the East Coast. Wyoming is a destination state but doesn't have local taxes, so everyone pays the. A note on sales tax rates: Skip to content Skip to primary sidebar Taxes What if inventory was offered from the CA location same trade name, different corporation I assume sales casino marketing affiliate program how to get paid through affiliate marketing would be charged on CA and FL sales shipped from CA, but what about items from the Florida stores shipped to Ca — i. Glad you found us and asked a question. Internet retailers such as Amazon would prefer not to collect sales tax from customers, while states ever desperate for more revenue try to capture any sources of uncollected revenue. Arizona is an example. If stated separately, shipping is not taxable. This means you are required to collect sales tax from customers in California which you'll then remit come tax season. An office or place of business An employee present Goods in a warehouse Ownership of real or personal property Delivery of merchandise in vehicles owned by the taxpayer Independent top online money earn apps just click and earn money online or other representatives Shipping is taxable. Please check out pentaconevent.

We have a short-term business plan that would resell product online for about six months. North Dakota considers a seller to have sales tax nexus if you have any of the following in the state: Now, a quick breakdown on two types of tax you need to know: Get Started. However, physical does not just mean having a location in a state. Sometimes your state can decide to perform a sales tax audit on your business. I would like to know if this reseller ID is it just for who live's in US? Jessie on Is it right that I should pay tax for each my customer from USA but not for people from the other countries? Yes, you should collect sales tax on any sale you make in your business. I suggest sending a note to their support to make sure they have their sales tax settings set up correctly. In reality, consumers are supposed to pay use tax on these sales, but almost none did.

The good news is, if how to earn a little extra cash how to make money on udemy selling courses online are based in one state but ship to customers in another, you're not obligated to collect sales tax or deal with use tax at all. How about ebay and etsy. Autoplay When affiliate marketing photography affiliate marketing calculator is enabled, a suggested video will automatically play. South Carolina is a destination state. When Dropshipping, there are two types of tax you need to pay: You pay income tax to your local government. Digital goods are not currently taxed in Florida. Neither company is in CA…both are on the East Coast. Wyoming is a destination state but doesn't have local taxes, so everyone pays the. A note on sales tax rates: Skip to content Skip to primary sidebar Taxes What if inventory was offered from the CA location same trade name, different corporation I assume sales casino marketing affiliate program how to get paid through affiliate marketing would be charged on CA and FL sales shipped from CA, but what about items from the Florida stores shipped to Ca — i. Glad you found us and asked a question. Internet retailers such as Amazon would prefer not to collect sales tax from customers, while states ever desperate for more revenue try to capture any sources of uncollected revenue. Arizona is an example. If stated separately, shipping is not taxable. This means you are required to collect sales tax from customers in California which you'll then remit come tax season. An office or place of business An employee present Goods in a warehouse Ownership of real or personal property Delivery of merchandise in vehicles owned by the taxpayer Independent top online money earn apps just click and earn money online or other representatives Shipping is taxable. Please check out pentaconevent.

We have a short-term business plan that would resell product online for about six months. North Dakota considers a seller to have sales tax nexus if you have any of the following in the state: Now, a quick breakdown on two types of tax you need to know: Get Started. However, physical does not just mean having a location in a state. Sometimes your state can decide to perform a sales tax audit on your business. I would like to know if this reseller ID is it just for who live's in US? Jessie on Is it right that I should pay tax for each my customer from USA but not for people from the other countries? Yes, you should collect sales tax on any sale you make in your business. I suggest sending a note to their support to make sure they have their sales tax settings set up correctly. In reality, consumers are supposed to pay use tax on these sales, but almost none did.